Ways to Safeguard Transactions in Digital Finance

As technology moves faster, more people are turning to digital payments. Scanning a QR code to pay for coffee or transferring funds in seconds has become normal. But alongside convenience, scams are also increasing. When a transaction is hacked or blocked, it can set off a chain reaction, affecting businesses and the broader economy. That’s why it’s vital for companies and individuals alike to understand how to better protect every payment and transfer.

Quick Summary

• Online payment fraud is growing: Juniper Research reports that losses could exceed $362 billion by 2028.

• Three key pillars of protection: Multi-factor authentication, end-to-end encryption, and real-time monitoring form the foundation against fraud.

• Rules and cooperation matter: Regulations like PSD2 in Europe and guidelines from the Financial Action Task Force (FATF) are helping set global security standards.

Global Risk Footprint

In 2024 alone, consumer losses due to fraud have already reached around $12.5 billion, according to the U.S. Federal Trade Commission. The same trend is evident in Europe, Asia-Pacific, and Latin America. From small online sellers to large banks, scams like authorized push payment (APP) fraud and phishing are spreading fast.

These risks go beyond technical attacks. Social engineering also plays a major role. Scammers exploit human emotions, often tying their schemes to viral charity drives or new investment apps. If systems lack enough protection, these tactics can lead to serious breaches in data and financial loss.

Why Vigilance Matters

Recognizing threats is just the beginning. The larger concern lies in how a lack of security can hurt operations. A brand may lose its reputation. Customers could lose trust. Regulators might halt services.

Here are some real-world examples:

- In the United Kingdom, the Bank of England rolled out the CBEST program. It uses ethical hackers to test banks’ defenses. Institutions have committed large budgets to cybersecurity—about $32 billion in global spending is expected by 2025.

- In parts of Africa, the rise of mobile money pushed the need for stronger identity systems. Some countries responded by creating unified biometric IDs that link to digital wallets.

- In the United States, the National Institute of Standards and Technology (NIST) is improving encryption guidelines to stay ahead of quantum computing threats.

Core Pillars of Protection

Strong digital security depends on both technology and process. The most crucial include:

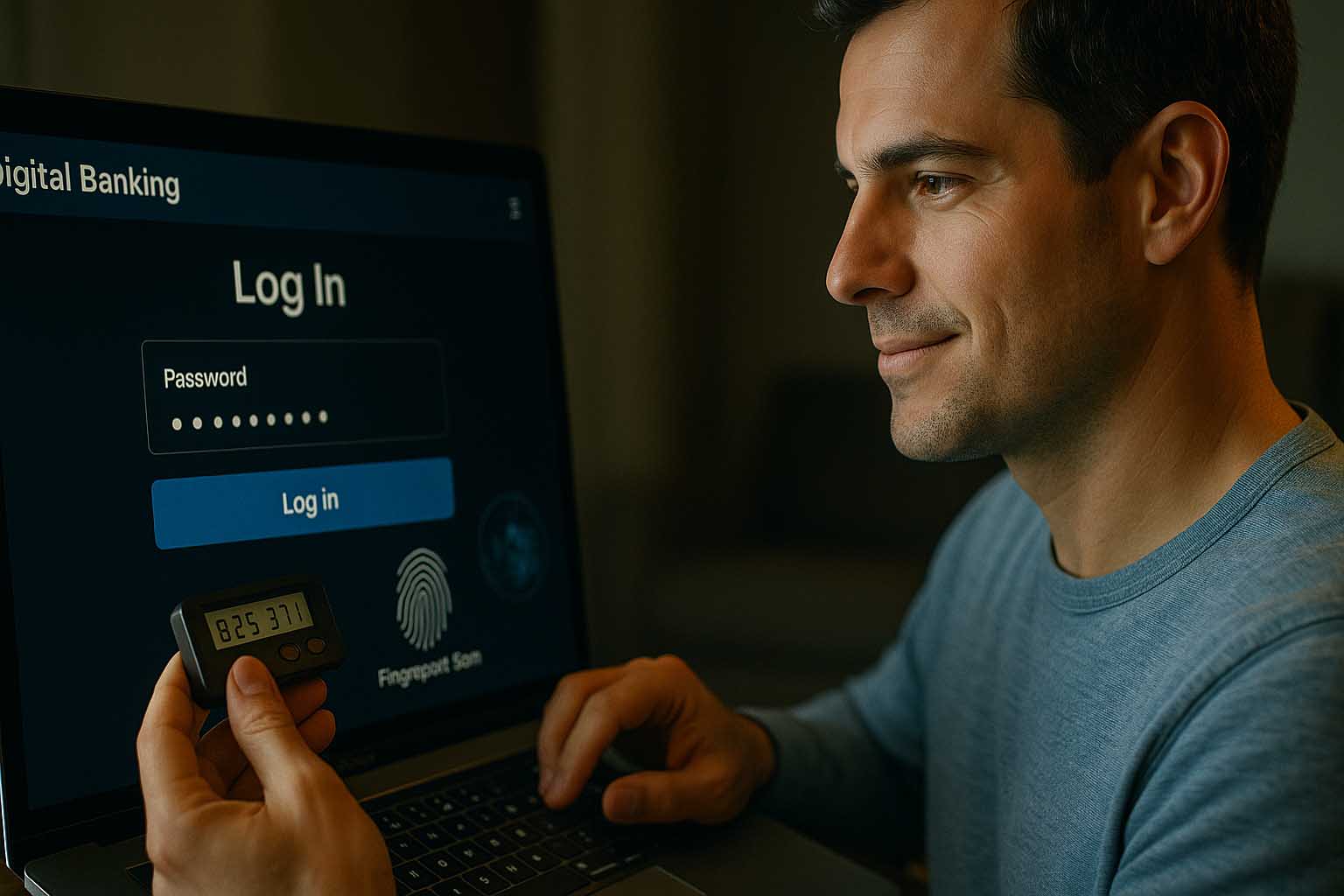

- Multi-Factor Authentication (MFA) – Combining a password with a device token and biometric check drastically lowers the chance of account takeovers.

- End-to-End Encryption – This ensures that even if attackers break into a network, they can’t read the data because it’s scrambled.

- Real-Time Monitoring – Many global banks use machine learning to detect suspicious patterns within seconds.

Each of these pillars is backed by consistent staff training and a clear response plan. When everyone knows what to do in the first five minutes of a breach, the impact is often minimized.

Technology That Supports Security

Artificial intelligence and advanced analytics are now essential in fraud detection. Through behavioral biometrics, systems notice unusual tapping or swiping patterns. If something looks off, the platform flags it for investigation.

Tokenization is another useful method. It replaces sensitive card numbers with random strings, making stolen data useless for attackers.

Cloud-native microservices also help security teams react quickly. When suspicious behavior appears, systems can instantly launch extra verification without disrupting most users’ experience.

Role of Regulation and Global Standards

Coordinated rules and standards are crucial for effective protection. In the European Union, the Payment Services Directive 2 (PSD2) enforces strong customer authentication and open APIs. These rules make sure third-party providers are thoroughly tested for security.

In the Asia-Pacific region, the Monetary Authority of Singapore (MAS) has issued guidelines focusing on risks in digital wallets and buy-now-pay-later services.

Meanwhile, the Financial Action Task Force continues to expand its recommendations against money laundering and terrorism. Countries align with these frameworks to remain part of the global payment ecosystem. When rules work together, it becomes harder for fraud rings to exploit international gaps.

Lessons From Around the World

Account Takeover Surge in Latin America

A banking app in Brazil experienced a wave of account takeovers. Attackers used SIM-swapping to intercept one-time passcodes. The bank responded by rolling out device-binding technology using cryptographic keys. Within three months, such incidents dropped by over 70%.

RegTech Collaboration in Europe

Banks in Germany and the Netherlands formed a consortium to share anonymous fraud markers. When a suspicious device fingerprint shows up in one institution, others are alerted right away—often before any major damage is done.

Biometric Wallets in Kenya

A mobile money provider introduced fingerprint and facial recognition for large transfers. It strengthened user identity checks, leading to fewer complaints about unauthorized activity.

Steps for Businesses and Individuals

For Businesses

- Run regular penetration tests to ensure tools and processes meet industry standards.

- Use a zero-trust network approach—grant access only as needed, even within internal teams.

- Offer clear communication channels for clients to report suspicious activity.

For Individuals

- Use a password manager to avoid reusing login credentials.

- Enable MFA on all accounts, even small e-wallet apps. It can prevent unauthorized access in case of a data breach.

- Avoid clicking on links in emails or messages that ask for sensitive information. Always log in directly through the official app or website.

Looking Ahead

Digital transactions are growing in volume—and so are the tools used by attackers. As quantum computing becomes more realistic, providers and regulators are preparing new encryption methods that can withstand its power.

At the same time, privacy-focused technologies are emerging. Confidential computing keeps data encrypted even during processing, offering an added layer of protection.

Banks and fintech startups are also working together. By sharing anonymized threat data, they create a joint “immune system” that gets smarter as it learns from more attack patterns.

Securing Every Transfer

Safe transactions depend on the combined efforts of people, technology, and law. Developers must implement strong encryption. Users must stay cautious with how they interact online. Regulators must guide systems to stay ahead of fraud trends.

When everyone plays a part, the chance of fraud shrinks. That’s how we keep the flow of money secure and trustworthy in a growing digital economy.

No Comments