Strengthening API Security in Financial Applications

The digital economy’s rapid growth has reshaped how people and organizations handle money across the globe. Daily activities such as transferring funds, paying utilities, managing investments, and monitoring accounts now happen through mobile devices and web platforms. Behind this convenience sits a critical technical foundation that keeps systems connected and functional: Application Programming Interfaces, commonly known as APIs.

APIs allow different financial systems to communicate securely and efficiently. Every payment request, balance inquiry, or transaction confirmation relies on these interfaces. Because they handle sensitive financial and personal data, API security stands at the center of trust in modern finance. Weak protection places users, institutions, and entire financial networks at risk.

This article examines why API security matters in financial applications, the threats APIs face, and the strategies used worldwide to protect them. A strong security approach helps safeguard digital transactions, maintain system reliability, and preserve public confidence in digital financial services.

Key points at a glance

- APIs act as the connection layer between financial applications, banks, payment networks, and fintech platforms worldwide.

- Poorly protected APIs expose systems to data theft, unauthorized access, and service disruptions.

- Strong authentication, encryption, access control, and continuous monitoring form the backbone of reliable API security.

- Global regulations and emerging technologies continue to shape how financial institutions protect API-driven systems.

How APIs Power Modern Financial Systems

APIs play a central role in nearly every digital financial service used today. When a user initiates a payment through a banking app, the app does not directly interact with the bank’s internal database. Instead, it sends a structured request through an API. The bank’s server processes that request and returns a response through the same interface.

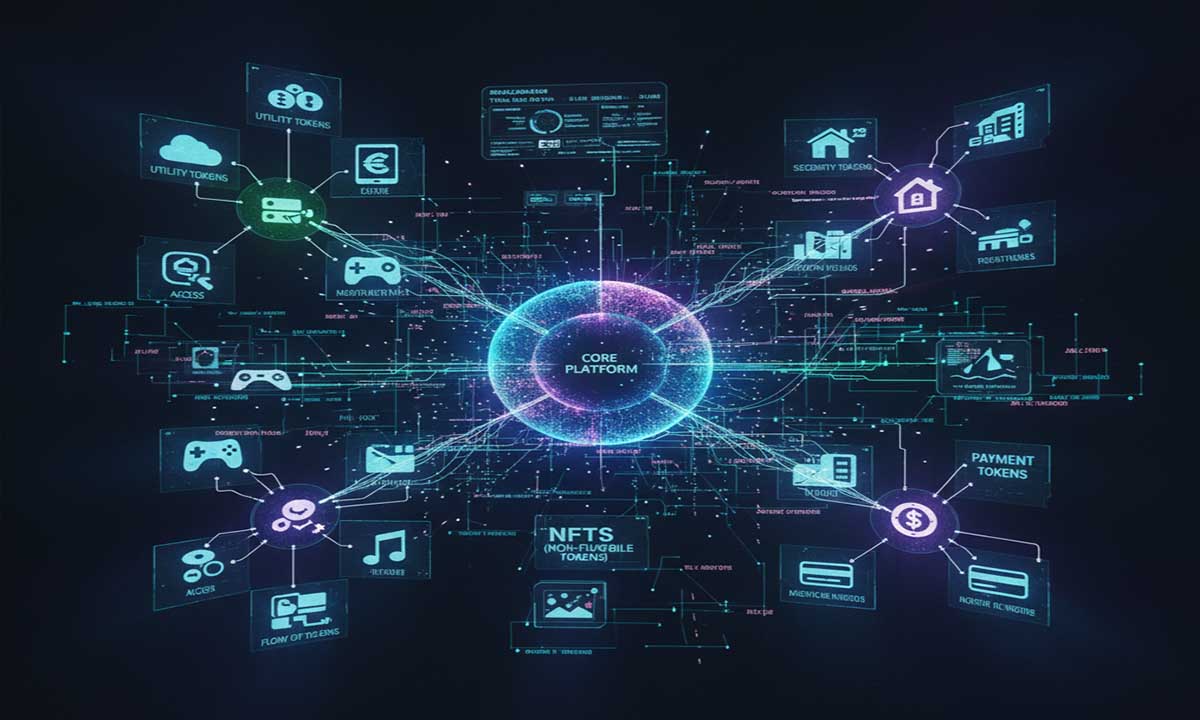

This design allows systems to remain modular and scalable. Banks, payment processors, credit card networks, and fintech platforms rely on APIs to share data without exposing internal systems. Online retailers use APIs to connect with global payment gateways. Budgeting tools retrieve transaction data through bank APIs to help users track spending patterns. Investment platforms depend on APIs for real-time pricing and trade execution.

Because APIs serve as gateways to financial data and operations, they handle highly sensitive information. Account identifiers, transaction histories, authentication tokens, and personal details all pass through these channels. Any weakness in API protection can compromise entire financial ecosystems, not just individual applications.

Security Risks Facing Financial APIs

APIs attract attackers because they often provide direct access to valuable data and functions. If security controls fail, APIs can become easy entry points into financial systems.

One common issue involves weak authentication and authorization. When identity checks are poorly implemented, attackers may impersonate legitimate users or services. This allows unauthorized access to accounts, transaction records, or administrative functions. Authorization gaps can also permit users to perform actions beyond their permitted role, such as viewing other customers’ data.

Excessive data exposure creates another risk. Some APIs return more information than the requesting application actually needs. While this may simplify development, it increases the potential impact of a breach. Extra data fields can reveal personal details or system structure that attackers may exploit.

Rate limiting failures also pose serious threats. Without limits on request volume, attackers can flood an API with repeated calls. This may lead to service outages or brute-force attempts to guess credentials. Financial services depend on availability, so even temporary disruption can damage trust and reputation.

Security misconfigurations remain a frequent concern worldwide. Improper server settings, outdated libraries, or poorly defined access rules can expose APIs unintentionally. These weaknesses often arise during rapid development cycles or system integrations involving multiple partners.

Building Strong Authentication and Access Controls

Authentication and authorization form the first line of defense for financial APIs. Multi-factor authentication adds an extra verification step beyond passwords. Even if login credentials are compromised, additional factors reduce the chance of unauthorized access.

Standardized frameworks such as OAuth 2.0 and OpenID Connect support secure access delegation. These protocols allow third-party applications to access user-approved resources without sharing passwords. This approach supports open banking initiatives and cross-platform services while keeping credentials protected.

Role-based access control limits what users and services can do once authenticated. Permissions align with job functions or application needs. A customer support system may view limited account details, while transaction processing systems gain access only to required payment functions. This reduces potential damage if an account becomes compromised.

Protecting Data Through Encryption

Encryption protects financial data during transmission and storage. Transport Layer Security encrypts data moving between applications and servers, preventing interception or tampering. This measure guards sensitive details such as account numbers, payment instructions, and authentication tokens.

Data stored in databases also requires protection. Encryption at rest ensures that even if storage systems are accessed unlawfully, the data remains unreadable without proper keys. Key management practices play a major role here, as weak handling can undermine otherwise strong encryption.

Together, these practices help ensure confidentiality and integrity throughout the data lifecycle.

Managing Traffic and Limiting Exposure

API gateways and firewalls act as control points for incoming and outgoing traffic. They inspect requests, enforce security policies, and block suspicious activity. These tools help filter malicious traffic before it reaches core financial systems.

Rate limiting restricts how many requests a user or system can make within a defined time window. This reduces the risk of brute-force attacks and service overloads. Well-designed limits balance security with usability, ensuring legitimate users experience smooth service.

Access restrictions also apply to network boundaries. Limiting API exposure to trusted networks or partners adds another protective layer, especially for internal financial services.

Continuous Testing and Monitoring

Regular testing identifies weaknesses before attackers exploit them. Vulnerability assessments and penetration testing simulate real-world attack scenarios. These exercises reveal flaws in authentication, data handling, and configuration.

Monitoring API activity supports early threat detection. Logs capture request patterns, errors, and access attempts. Sudden spikes in traffic or repeated authorization failures can signal malicious behavior. Prompt analysis allows teams to respond quickly and minimize impact.

Effective monitoring combines automated alerts with human oversight. This approach supports both immediate response and long-term improvement.

Secure Development and Key Management

Security begins during development. Input validation, proper error handling, and adherence to established coding standards reduce common vulnerabilities. Developers benefit from using tested security frameworks rather than building custom solutions from scratch.

API keys and secrets require careful management. Hardcoding credentials into applications creates unnecessary risk. Secure storage systems and regular key rotation help limit exposure. Access to keys should follow strict controls and auditing.

Training developers in secure coding practices strengthens defenses from the earliest stages of system design.

Ongoing Challenges in API Security

Maintaining strong API security remains complex. Technology evolves rapidly, and new attack techniques appear frequently. Financial institutions must update defenses continuously to remain effective.

Legacy systems present additional difficulty. Older platforms may not align with modern security standards, making integration challenging. Upgrading these systems often requires significant investment and careful planning.

Skills shortages also affect global organizations. API security demands specialized knowledge. Regular training and awareness programs help teams stay prepared.

Regulatory compliance adds another layer of responsibility. Financial institutions must meet data protection regulations set by regional and international bodies. Failure to comply can lead to financial penalties and reputational harm. Aligning API security with regulatory expectations supports both legal compliance and user trust.

Future Directions for Financial API Security

As digital finance continues to expand, APIs will become even more central to financial operations. Security approaches will adapt accordingly. Artificial intelligence and machine learning already support threat detection by identifying unusual traffic patterns and behavior.

Zero trust models gain traction across industries. Under this approach, every request must be verified, regardless of origin. This model reduces reliance on network boundaries and strengthens API protection in distributed environments.

Microservices architectures increase the number of APIs in use. Each service interaction introduces potential risk, making consistent security controls essential. Coordination among financial institutions, technology providers, and regulators will support shared understanding of emerging threats.

Trust as the Foundation of Digital Finance

API security in financial applications extends beyond technical safeguards. It supports confidence in digital systems that manage money, savings, and investments worldwide. Users expect their data to remain private and transactions to process accurately.

Strong security practices protect individuals and institutions alike. As financial services continue to rely on interconnected systems, careful attention to API security will help maintain stability and confidence across the global financial landscape.

No Comments