Understanding the Dynamics of Digital Tokens in a Global Economy

As digitalization continues to reshape our world, digital tokens have become an integral part of modern experiences. From gaming to financial transactions, these tokens are transforming the way we interact, exchange value, and even think about ownership. Simply recognizing their presence is not enough; understanding how these systems operate is essential for anyone aiming to actively participate in the expanding digital economy.

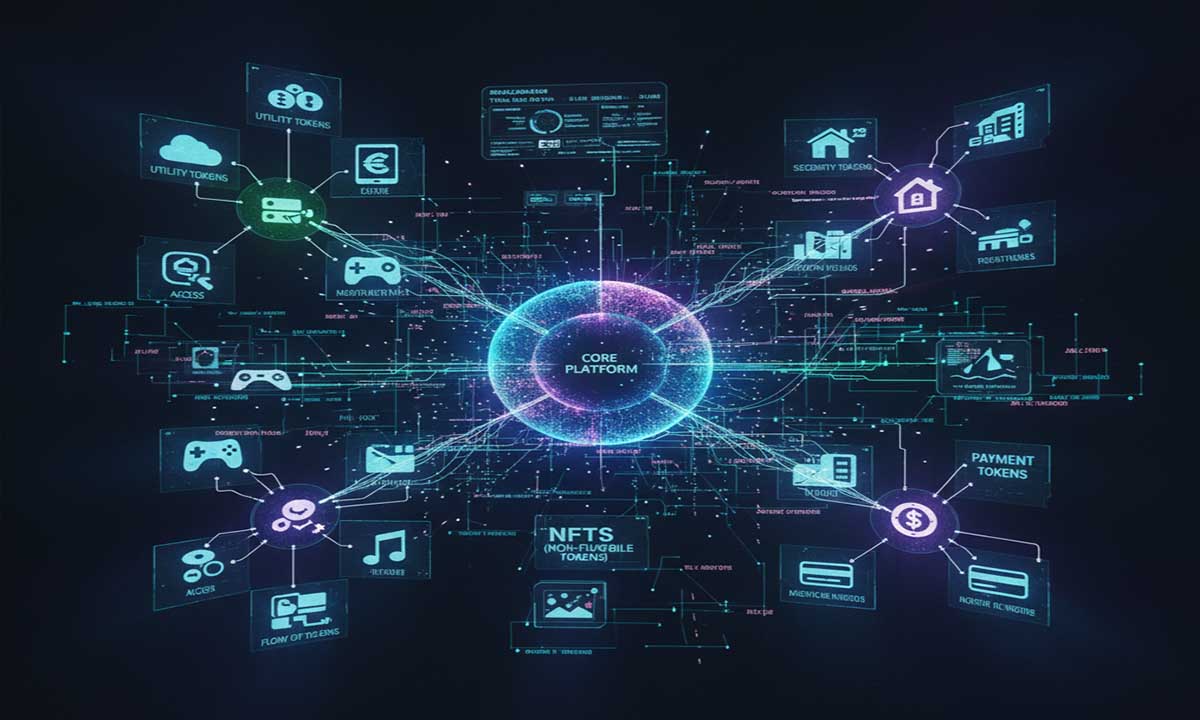

Quick Overview of Digital Tokens

Digital tokens represent more than value- they form the backbone of many digital ecosystems, enabling new forms of ownership, exchange, and governance.

Tokens come in various types, each serving a specific purpose, from utility and security tokens to payment tokens and non-fungible tokens (NFTs).

Key mechanisms like blockchain, smart contracts, and decentralization ensure security, transparency, and efficiency for token systems worldwide.

This overview highlights the core aspects of digital tokens, providing a foundation for exploring their creation, use, and global implications.

Core Principles of Digital Tokens

At the heart of every digital innovation lies a foundational concept, and in the digital value landscape, these are tokens. Digital tokens act as representations of ownership, rights, or value within a digital framework. Their forms are diverse, and each type plays a distinct digital ecosystem role.

Utility Tokens: These tokens grant access to specific services or products on a platform. For instance, a token may allow voting in an online community or provide access to a limited storage network. Its value directly relates to the utility it offers.

Security Tokens: Representing ownership of real-world assets, such as shares in a company or property, these tokens comply with financial regulations similar to traditional investments.

Payment Tokens: Designed for exchanging or storing value, these include well-known cryptocurrencies.

Non-Fungible Tokens (NFTs): Unique and indivisible, NFTs often represent digital art, music, or collectibles, offering distinct value in the digital realm.

Understanding these distinctions is the first step toward recognizing how tokens influence business practices and interactions globally, even shaping new investment models.

How Token Systems Operate

The operation of digital tokens relies heavily on underlying technologies. Often, the backbone of these systems is the blockchain- a decentralized digital ledger maintained by thousands of computers worldwide. Every transaction is recorded in a block, which links sequentially to the previous one. Complex cryptography ensures that altering recorded data is nearly impossible without detection, guaranteeing security and trust across global networks.

Smart Contracts play a vital role as well. These self-executing agreements, stored on the blockchain, automatically implement actions when predefined conditions are met. For example, a token sale can automatically transfer ownership once payment is confirmed, eliminating the need for intermediaries.

Decentralization further strengthens token systems. Unlike traditional frameworks controlled by a central authority, decentralized networks distribute power across participants. This approach enhances security, transparency, and resilience by reducing single points of failure. Network members can verify transactions, reinforcing trust within the ecosystem. Combining blockchain, smart contracts, and decentralization enables robust, innovative digital token governance on a global scale.

Token Creation and Distribution

Creating and distributing tokens involves multiple methods designed to efficiently reach various audiences:

- Initial Coin Offering (ICO): A digital version of an IPO, where a project sells newly created tokens to the public to fund platform development. Investors acquire tokens, hoping their value will increase as the project grows.

- Initial Exchange Offering (IEO): Similar to an ICO but managed by a cryptocurrency exchange, providing credibility and security for investors through due diligence.

- Airdrops: Tokens distributed for free to user wallets meeting specific criteria, often used for marketing or rewarding loyal community members.

- Mining and Staking: Mining involves solving complex computational problems to verify transactions and create new tokens, while staking allows users to lock tokens to support network operations in exchange for rewards.

Each method carries advantages and considerations, depending on the project’s goals and token type.

Token Use and Value

A token’s true value often stems from its purpose within an ecosystem. These digital instruments enable diverse interactions and opportunities, often reflecting the creativity of their creators.

Access: Tokens can serve as entry keys to exclusive online communities, premium content, or specialized services. They act similarly to loyalty points in traditional programs, rewarding participation and engagement.

Governance: In decentralized organizations (DAOs), token holders may vote on crucial decisions affecting project direction, funding allocation, or platform policies, creating a transparent decision-making system.

Rewards: Some platforms distribute tokens as incentives for quality contributions. For example, users providing valuable content on social platforms may receive tokens as recognition for their efforts.

Financial Utility: Tokens representing monetary value can be used for payments. Their value fluctuates based on supply, demand, market conditions, and utility, emphasizing their practical role in a global financial ecosystem.

Ensuring Security and Stability

Security and stability are critical in systems involving value, whether digital or physical. Token networks face unique challenges due to decentralization and potential value volatility.

Blockchain Security: Cryptography secures transactions, making unauthorized alterations extremely difficult.

Smart Contract Audits: Regular expert reviews prevent vulnerabilities in automated code that could be exploited.

Risk Management: Strong passwords, two-factor authentication, and secure storage of private keys are essential for individual token owners. Exchanges and platforms must adopt best practices like offline storage for major funds.

Regulatory Compliance: Governments worldwide are establishing rules for tokens and cryptocurrencies, protecting investors, preventing money laundering, and maintaining financial system integrity. Such regulations enhance trust and adoption across traditional and digital economies.

Through diligent technology and regulatory measures, token systems achieve reliability and credibility on a global scale.

Future Directions of Token Mechanics

The digital token landscape is continually expanding, creating opportunities for innovation across sectors. Token mechanics evolve alongside emerging technologies, opening new applications beyond traditional transactions.

Integration with Advanced Technologies: Artificial intelligence (AI) can enhance security, detect threats, and optimize operations. AI-powered algorithms can analyze blockchain transactions in real time, maintaining balance and integrity in decentralized finance.

Expanding Applications: Tokens now support supply chain transparency, tracking goods from origin to consumer. In healthcare, tokens provide secure management of medical records and controlled access. Each innovation demonstrates the potential to transform traditional industries worldwide, showcasing advanced blockchain solutions.

Layer-2 Solutions and Cross-Chain Compatibility: These technologies improve transaction speed and reduce costs, addressing blockchain scalability issues. Seamless movement of tokens across different blockchains promotes interoperability and a more interconnected digital economy.

As systems continue to evolve, token mechanics remain central to shaping a secure, decentralized, and globally relevant digital economy.

Looking Ahead: Embracing the Digital Value Shift

Understanding digital token systems is no longer exclusive to technology enthusiasts or finance experts. Anyone engaging in the rapidly changing digital economy benefits from knowing how tokens are created, distributed, and utilized. Digital tokens represent a new mode of interaction, exchange, and value creation, connecting people and systems worldwide.

By mastering their dynamics, individuals and organizations alike can navigate opportunities, manage risks, and participate meaningfully in the evolving global digital landscape.

No Comments